domain:greyenlightenment.com

To add, work is more than earning a living. It's about creating social boundaries and ownership/control of one's time or whom one associates with. It's also about social status and connections. This can explain why many people continue to work even when no longer financially necessary. Living in America is especially stressful for middle-aged people, also known as the sandwich demographic, so work is an escape for these people. The option always exists to work less, but then you lose those boundaries. Not working means you're suddenly available. If people only chose to work for the sake of earning a living, people would work much less than they do.

Submission statement

-

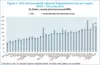

The college debt debate overlooks the huge college wage premium and focuses instead on the nominal amount of debt, which although large, is still small relative to wages. Americans earn among the highest incomes in the world, when combined with low taxes, makes college even more worthwhile. I was surprised myself to see that the average income for college grads is so high: $70k. Just a few decades ago, it seemed like high 5 figures was uncommon, but now the norm. When you make so much, who cares about $3-5k/year in student loan payments.

-

The incentives are aligned in such a way as to encourage the accumulation of a lot of debt, whether it's college or home ownership. Savers seem to miss out (penny wise, pound foolish as it's said). This goes against conventional wisdom that debt is bad or saving is always good. The people who seem to have the most wealth by their late 30s or 40s seem to be those who took on a lot debt in 20s and invested heavily in education, like student loan debt , graduate degrees, and mortgages.

-

Students can take advantage of low interest rates with federal loans despite having no credit history, which is not possible with private debt. Also, tons of forgiveness plans and forbearance. This creates an incentive to take on debt.

-

In the job market, not having a degree puts one at an obvious disadvantage compared to degree holders. Unless everyone defects, it's disadvantageous from an individual perspective to forgo college.

-

Trade schools may not live up to hype and can be as expensive as 4-year degrees.

Rising interest rates will make this less lucrative, especially #2. On Reddit 'FIRE' subs, almost everyone who got rich over the past decade took advantage of low interest rates and surging asset prices after finishing college. But even with high interest rates and high inflation, college educated workers still fare much better. But it looks like 10+ year bond yields are crashing again. It's the same pattern of long-term rates falling like rock when even the slightest hint of economic weakness shows, or even for no reason at all. The era of 6+ % 10-year bonds like in the 80s,90s, and so, are over for good. There is too much demand from pensions and other sources buying up any long term treasury yielding 3% or more.